How do fintech companies contribute to the economic recovery of small businesses? Fintech firms have emerged as pivotal players in offering PPP loans, aiding countless enterprises across the United States. These financial technology companies leverage advanced digital tools and platforms to streamline loan application processes, ensuring quicker access to funds for struggling businesses. The Paycheck Protection Program (PPP), established under the CARES Act, has been instrumental in providing much-needed financial relief. Fintech companies have played a crucial role in administering these loans efficiently, enabling businesses to retain their workforce and maintain operations during challenging times.

Among the notable fintech companies now approved to offer PPP loans are names such as Kabbage, Square Capital, OnDeck, LendingClub, and BlueVine. Each of these organizations brings unique strengths to the table. For instance, Kabbage, acquired by American Express, offers a user-friendly interface that simplifies the loan application process for small business owners. Similarly, Square Capital, part of the broader Square ecosystem, leverages its existing relationships with merchants to provide tailored financial solutions. OnDeck, another prominent player, is renowned for its rapid approval process, which ensures businesses receive funding within days. Meanwhile, LendingClub focuses on fostering long-term partnerships with borrowers, while BlueVine emphasizes transparency and flexibility in its lending practices.

| Company Name | Headquarters | Year Founded | Website |

|---|---|---|---|

| Kabbage | Atlanta, GA | 2009 | kabbage.com |

| Square Capital | San Francisco, CA | 2014 | |

| OnDeck | New York, NY | 2007 | ondeck.com |

| LendingClub | San Francisco, CA | 2007 | lendingclub.com |

| BlueVine | Redwood City, CA | 2013 | bluevine.com |

In addition to these primary lenders, several fintech firms assist small businesses in navigating the PPP loan application process. Companies like Nav and Fundbox offer comprehensive resources and support, guiding entrepreneurs through the often complex requirements. Nav provides a detailed eligibility checker and helps users compare various loan options, ensuring they secure the best possible terms. Fundbox, on the other hand, specializes in short-term financing solutions, complementing PPP loans by addressing immediate cash flow needs.

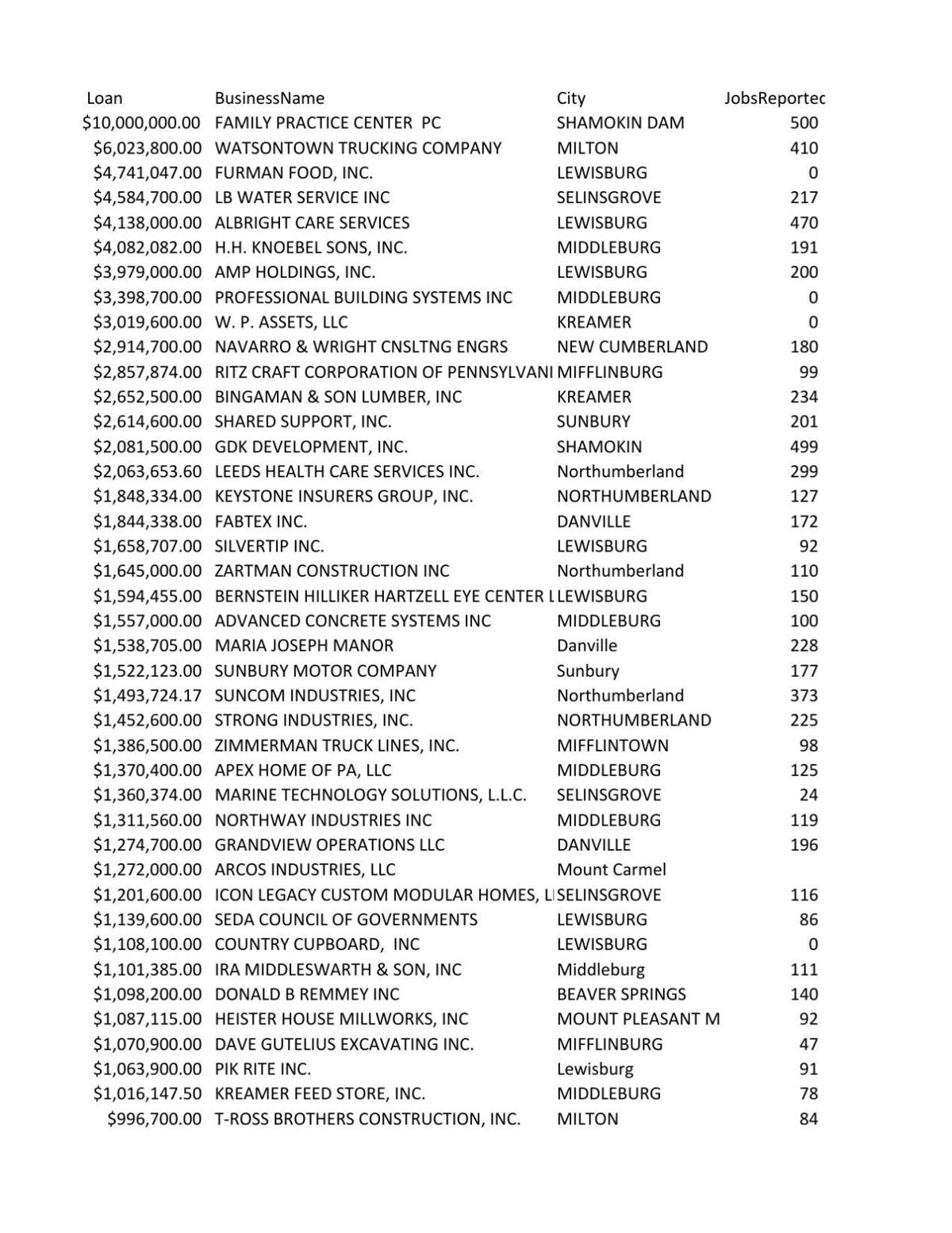

The Small Business Administration (SBA) regularly updates its PPP loan data directory, making it accessible for public review. As of March 7, 2025, all PPP loan information can be downloaded in CSV format from the official SBA website. This dataset includes details about each borrower, the loan amount disbursed, and the industry served. Such transparency aims to enhance accountability and foster trust between lending institutions and the communities they serve.

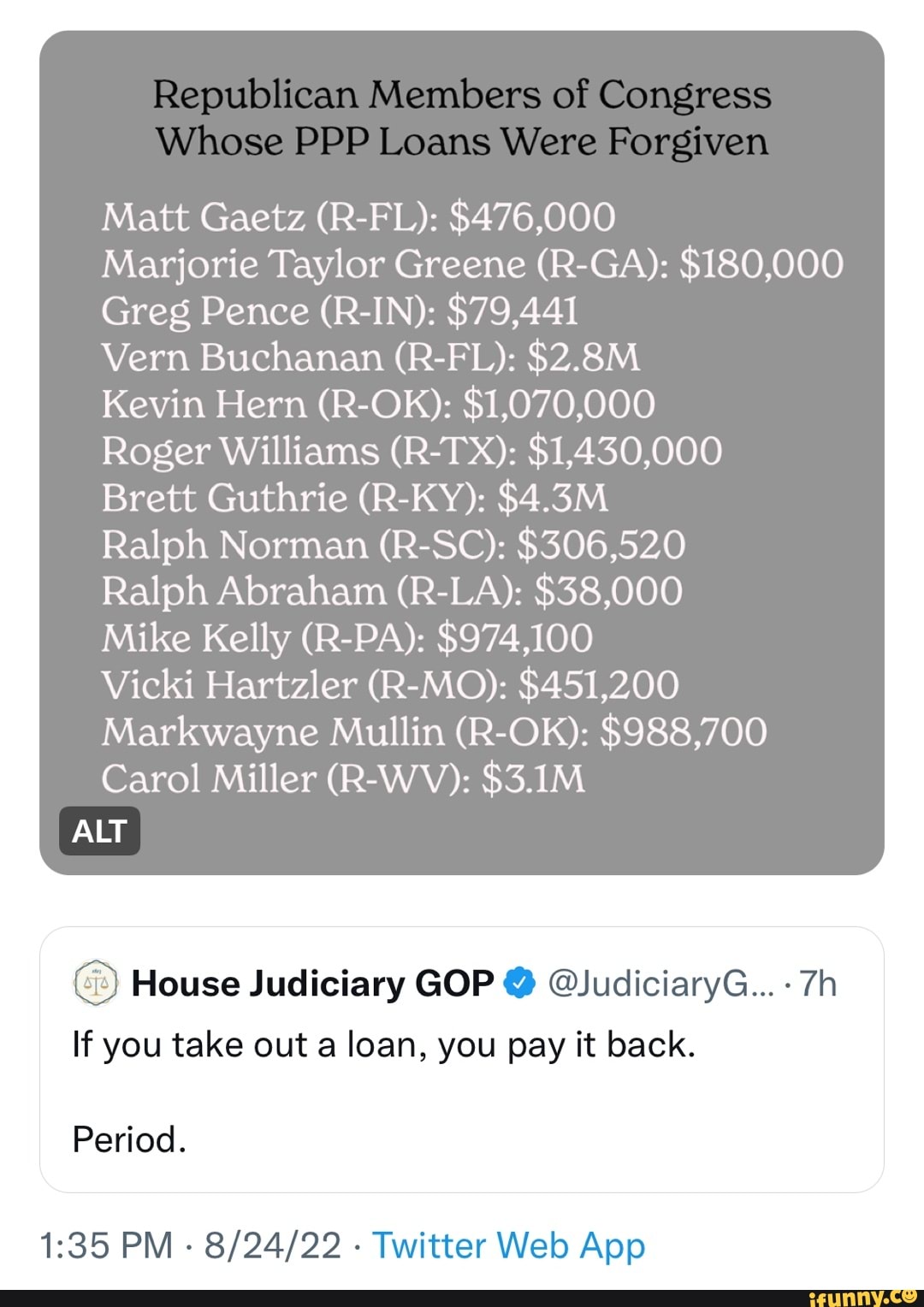

Despite the positive impact of PPP loans, instances of fraud have surfaced, raising concerns among regulators and law enforcement agencies. One high-profile case involves Shashank Shekhar Rai, who was charged with multiple counts of fraud related to PPP applications. Allegations against him include wire fraud, bank fraud, and providing false statements to both financial institutions and the Small Business Administration. Legal experts emphasize the importance of thorough documentation when applying for PPP loans to avoid potential pitfalls. Their advice centers around meticulously reviewing all submitted documents and maintaining clear communication with lenders throughout the process.

Attorney General Chris Carr of Georgia announced the indictment of 21 individuals in Mitchell County accused of fraudulent PPP activities. According to the indictments, these defendants falsely claimed ownership of non-existent businesses and fabricated financial data to secure unauthorized loans. Such actions not only undermine the integrity of the PPP program but also divert critical resources away from legitimate recipients. Efforts are underway to prosecute offenders and recover misappropriated funds.

Franchisees and franchisors alike may request inclusion in the PPP loan directory, provided they meet specific criteria outlined by the SBA. Notably, affiliation rules do not apply to franchise brands, allowing them greater flexibility in accessing PPP funds. This exemption recognizes the distinct operational structures of franchises and seeks to ensure equitable treatment across different business models.

Connecticut's experience with PPP loans underscores the complexities inherent in large-scale financial assistance programs. With $6.7 billion distributed statewide, the initiative supported numerous enterprises, including FuelCell Energy Inc., a publicly traded company employing hundreds in Danbury and Torrington. However, challenges remain, highlighting the need for improved oversight mechanisms and enhanced communication channels between stakeholders.

Pandemic Oversight maintains an interactive PPP borrower search tool, enabling users to explore loan distributions by location and sector. This resource facilitates deeper understanding of how PPP funds are allocated and utilized, empowering citizens to engage more meaningfully with economic recovery efforts. By leveraging technology and fostering collaboration, fintech companies continue to play a vital role in supporting small businesses nationwide.