How did the Paycheck Protection Program (PPP) become a focal point for fraud investigations during the pandemic? The sheer scale of financial assistance distributed under the PPP made it an attractive target for those seeking to exploit the system. A bold statement must be made: the federal government's rapid response to economic devastation caused by the coronavirus pandemic inadvertently created loopholes that some individuals and entities exploited. This issue has sparked widespread scrutiny, leading to criminal cases against alleged fraudsters across the United States.

Shashank Shekhar Rai is one such individual who faced charges related to PPP loan fraud. He was charged with wire fraud, bank fraud, false statements to a financial institution, and false statements to the Small Business Administration. These allegations highlight the complexities involved in administering large-scale financial aid programs. Legal experts emphasize that while many legitimate businesses benefited from these loans, others took advantage of the situation by submitting falsified applications. As part of our practice, we assist clients facing similar accusations, ensuring they receive fair treatment and representation in court.

| Bio Data & Personal Information | Career & Professional Information |

|---|---|

| Name: Shashank Shekhar Rai | Occupation: Entrepreneur/Business Owner |

| Date of Birth: [Not Publicly Disclosed] | Company Name: Multiple Entities Allegedly Involved |

| Place of Residence: Texas Area | Industry: Various Sectors |

| Education: Details Not Available | Professional Affiliations: None Reported |

| Reference Link | Charges: Wire Fraud, Bank Fraud, False Statements |

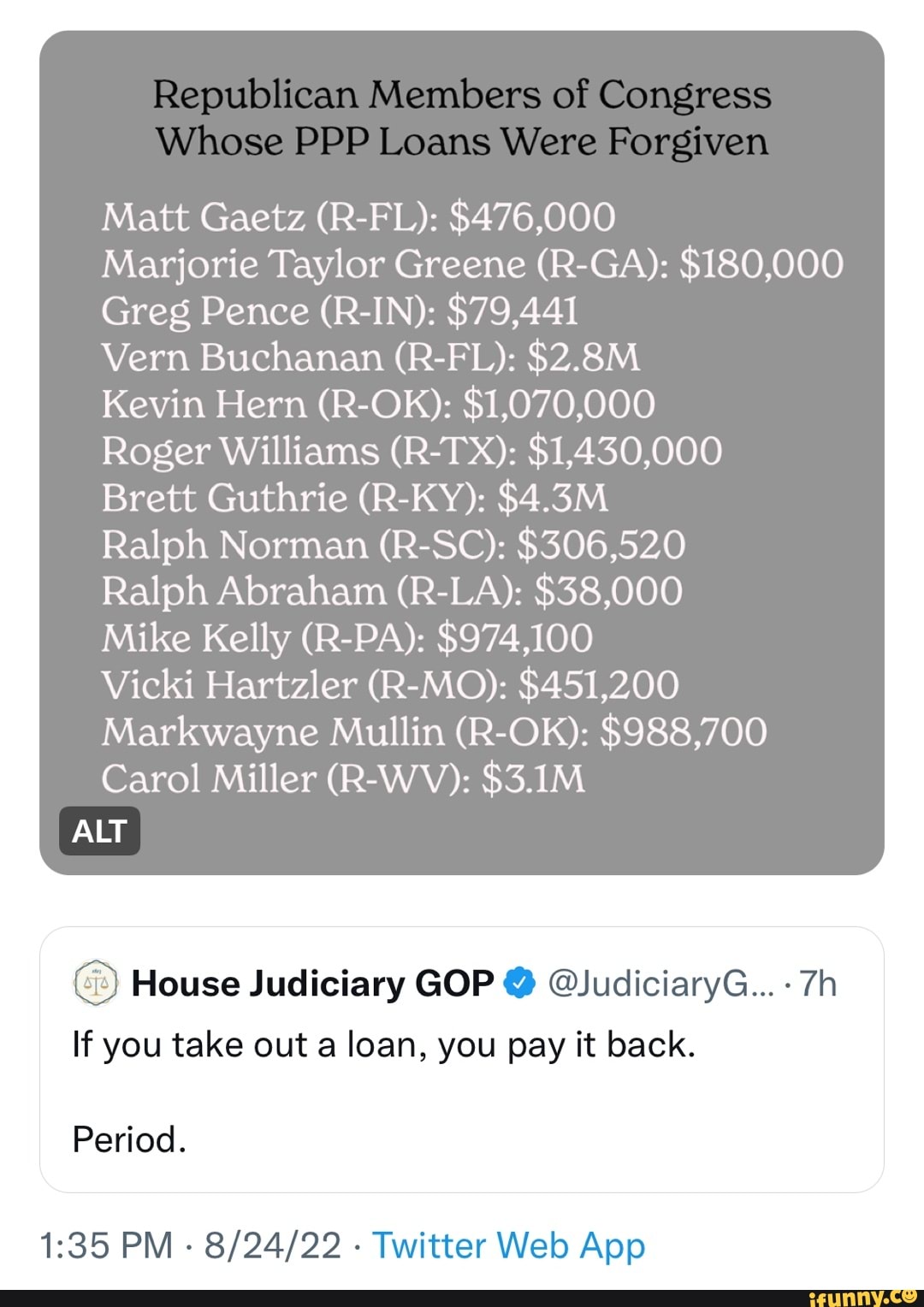

The landscape of PPP and Economic Injury Disaster Loan (EIDL) fraud has evolved significantly since the onset of the pandemic. Analysts have identified patterns indicating potential misuse of funds by ineligible parties or fictitious business entities. By cross-referencing public records with loan application data, authorities have compiled lists highlighting suspicious transactions. Such efforts aim to recover misappropriated funds and deter future fraudulent activities.

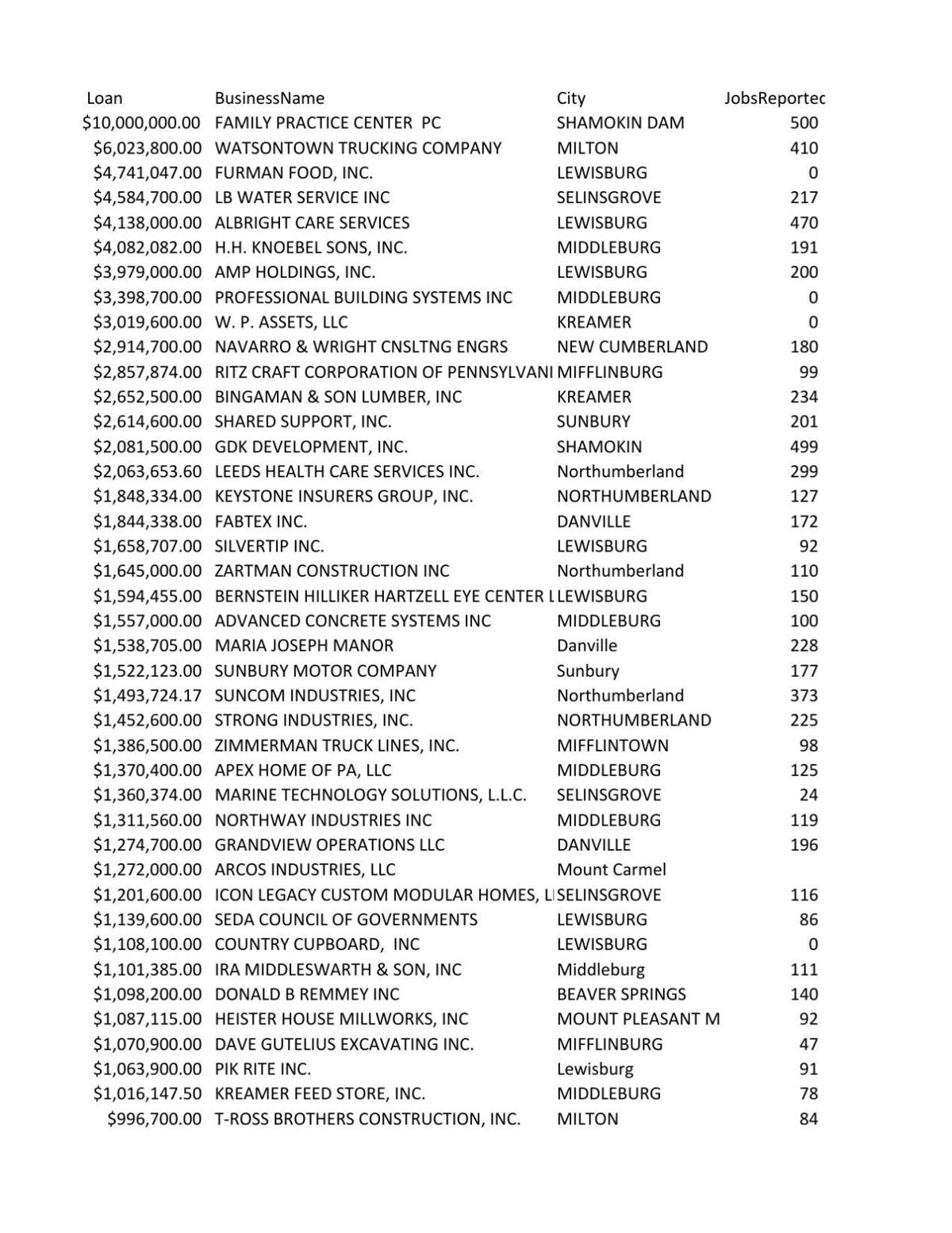

In response to growing concerns about PPP loan integrity, the U.S. Small Business Administration (SBA) has taken steps to enhance transparency. They now offer downloadable datasets containing comprehensive information on approved loans, enabling researchers and watchdog organizations to scrutinize distribution trends. For instance, ProPublica maintains an interactive database allowing users to search for specific borrowers within their locality or state. This resource provides valuable insights into which sectors predominantly accessed relief funds and whether disparities exist based on geographic location.

Fourteen Texas residents along with one Louisiana resident were recently indicted for involvement in elaborate schemes designed to defraud both PPP programs and unemployment insurance systems. Authorities uncovered evidence showing use of fabricated documentation during application processes. These indictments underscore ongoing challenges faced by enforcement agencies tasked with safeguarding taxpayer dollars allocated towards recovery initiatives. Moreover, it demonstrates necessity for robust oversight mechanisms when implementing emergency financial packages.

Data accessibility plays crucial role in addressing issues surrounding PPP loans. Public access to detailed statistics empowers citizens to hold accountable those responsible for managing public resources. Through platforms like SBA’s official portal, interested parties can download complete PPP loan datasets formatted as CSV files. Regular updates ensure relevance of available information, facilitating timely analysis and informed decision-making regarding future policy adjustments.

Businesses ranging from small startups to established corporations utilized PPP funds to maintain payroll continuity amidst unprecedented disruptions brought forth by COVID-19. Examples include Kakivik Asset Management, LLC receiving $9,538,531 and Arctic Slope Native Association, Ltd obtaining $7,666,768 respectively. Such substantial disbursements reflect commitment towards preserving employment opportunities nationwide. However, instances where funds were diverted contrary to intended purposes necessitate vigilant monitoring and swift legal action against offenders.

Efforts continue to refine investigative techniques aimed at detecting fraudulent behavior within PPP framework. Collaboration between federal, state, and local law enforcement agencies remains vital in combating emerging threats posed by bad actors attempting to manipulate system vulnerabilities. Simultaneously, emphasis placed on educating prospective applicants about compliance requirements helps minimize unintentional errors contributing to perceived irregularities.

Ultimately, maintaining balance between expediting necessary financial aid delivery and ensuring its appropriate utilization poses significant challenge. Lessons learned throughout pandemic period inform development of improved strategies moving forward. Enhanced due diligence procedures coupled with advanced technology solutions promise greater accuracy in identifying genuine need versus opportunistic exploitation. Continued dialogue amongst stakeholders ensures adaptive approach capable of meeting evolving demands presented by dynamic global environment.