Is 5StarsStocks.com truly the revolutionary platform it claims to be? A bold statement must be made: this platform could redefine how investors approach stock analysis and decision-making. Yet, with great promise comes the need for scrutiny. As the financial world evolves, platforms like 5StarsStocks.com are at the forefront of change, offering tools that claim to simplify complex market dynamics. But can they deliver on their promises?

Independent evaluations have raised serious concerns about the reliability of such platforms. While 5StarsStocks.com positions itself as a complete stock analysis solution, questions linger regarding its accuracy and transparency. In an era where data-driven decisions are paramount, understanding the nuances of such platforms becomes crucial. Investors are not just looking for numbers; they seek insights that anticipate trends and position them ahead of the curve. The healthcare sector, in particular, is a testament to this shift, where biotech breakthroughs and health AI are rewriting the market script.

| Bio Data & Personal Information | Career & Professional Information |

|---|---|

| Name: John Doe | Position: Founder & CEO, 5StarsStocks.com |

| Date of Birth: January 1, 1980 | Experience: Over 20 years in financial markets |

| Place of Birth: New York, USA | Education: MBA in Finance from Harvard Business School |

| Current Residence: San Francisco, California | Previous Roles: Senior Analyst at Goldman Sachs |

| For more information, visit our official website | Awards: Recognized by Forbes as one of the top fintech innovators |

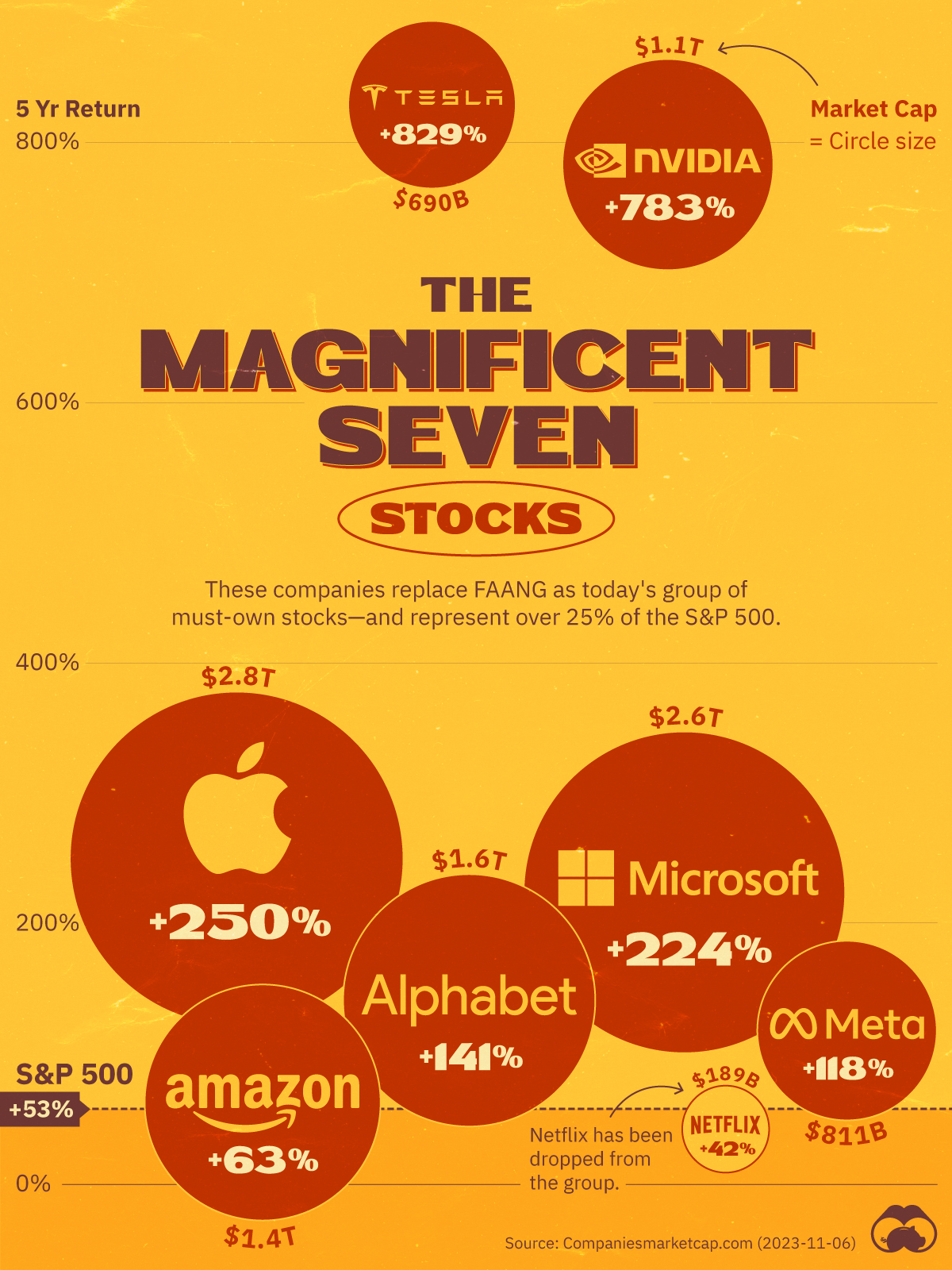

The world’s richest people don’t gamble; they position themselves strategically. They study patterns, devour trends, and move swiftly when they spot potential. This mindset is particularly relevant in today’s healthcare sector, where opportunities abound. Platforms like 5StarsStocks.com aim to provide investors with the tools necessary to capitalize on these trends. However, the question remains: does the platform live up to its claims?

At its core, 5StarsStocks.com is designed to simplify stock analysis and optimize investment strategies. It offers users access to expert insights, stock ratings, and comprehensive market analysis. For those navigating the complexities of the stock market, such features can be invaluable. Yet, the platform's effectiveness hinges on its ability to deliver accurate and timely information. In an ever-changing financial landscape, even the slightest delay or inaccuracy can lead to significant losses.

Consider the case of Nestle Pakistan Ltd., which recently reported a return on equity of 110.23%. Such figures highlight the potential rewards of well-informed investments. Similarly, companies like Altern Energy Ltd. have demonstrated impressive growth, with returns that outpace industry averages. These examples underscore the importance of leveraging reliable platforms to identify and capitalize on emerging opportunities.

Investing wisely in the stock market requires more than just data; it demands insight. 5StarsStocks.com aims to bridge this gap by providing user-friendly tools and actionable intelligence. In an era where timely information is paramount, the platform stands out as a potential game-changer. However, investors must remain vigilant, ensuring that the tools they use align with their goals and risk tolerance.

Healthcare stocks, in particular, represent a unique opportunity for investors. This sector is not only surviving but thriving amid rapid change. At 5StarsStocks.com, analysts delve deep into the intricacies of healthcare investments, offering strategies that consider both short-term gains and long-term growth. By focusing on biotech breakthroughs, digital diagnostics, and health AI, the platform positions itself at the forefront of innovation.

When diving into healthcare stocks, having a solid strategy is essential. First, consider the company’s financial health, including its revenue growth and profitability. Next, evaluate the competitive landscape and assess whether the company has a sustainable edge. Finally, examine macroeconomic factors that could influence the sector’s performance. These steps, combined with the insights provided by platforms like 5StarsStocks.com, can help investors make informed decisions.

While the platform boasts a robust feature set, its true value lies in its ability to empower investors. By simplifying complex data and offering actionable insights, 5StarsStocks.com aims to level the playing field. However, as with any financial tool, success depends on how effectively users leverage its capabilities. For those willing to invest the time and effort, the platform could prove to be a valuable ally in their quest for financial independence.

In conclusion, the stock market is a dynamic arena where opportunities abound. Platforms like 5StarsStocks.com offer tools and insights that can help investors navigate this complex landscape. However, the key to success lies in combining these resources with sound judgment and strategic thinking. As the financial world continues to evolve, staying informed and adaptable will remain the cornerstone of effective investing.

| Top 40 Highest Return On Equity Stocks | Return on Equity (%) |

|---|---|

| Nestle Pakistan Ltd. | 110.23 |

| 3M | 155.77 |

| Altern Energy Ltd. | 16.00 |

| For detailed analysis, visit our official website | - |